Personal loans

Offer smarter, all-digital personal lending

Deploy Upstart’s Lender-Branded Platform on your institution’s website to offer a turnkey, all-digital lending experience, enabled by AI.

Deploy Upstart’s Lender-Branded Platform on your institution’s website to offer a turnkey, all-digital lending experience, enabled by AI.

Offer a modern, all-digital personal lending experience on your website that is powered by Upstart while delivering higher approval rates and lower loss rates, all enabled by AI.

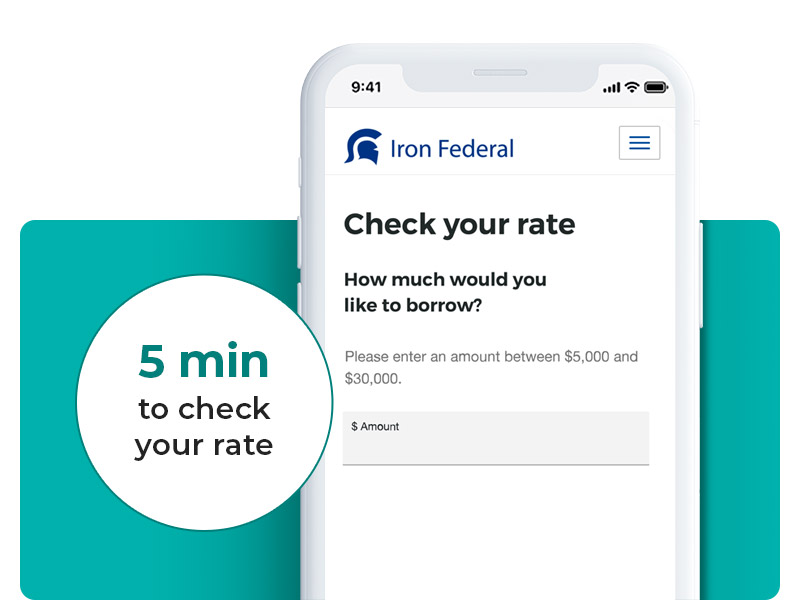

Lender-branded, mobile-friendly application that allows users to finish their application in one sitting.

Pre-filled application with existing customer information creates a quick and easy process.

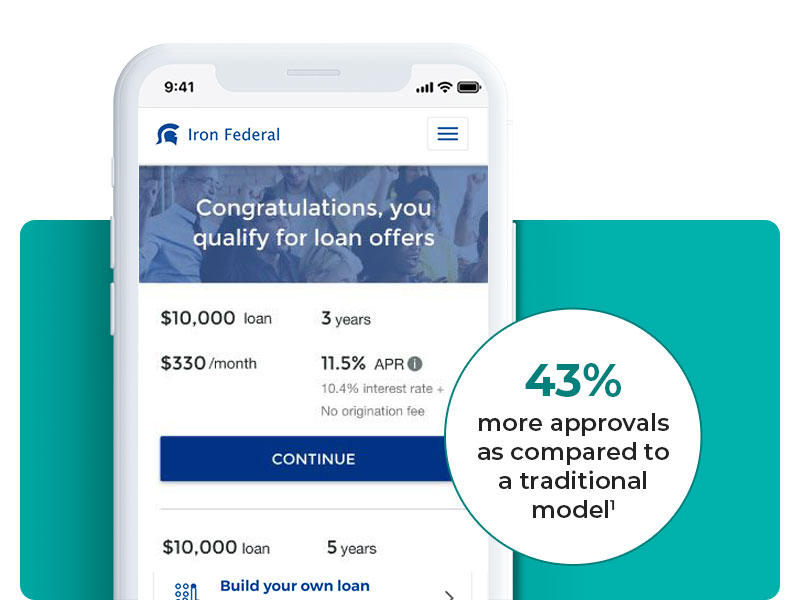

Risk-based AI model prices customers within your credit criteria resulting in higher approvals and lower losses.

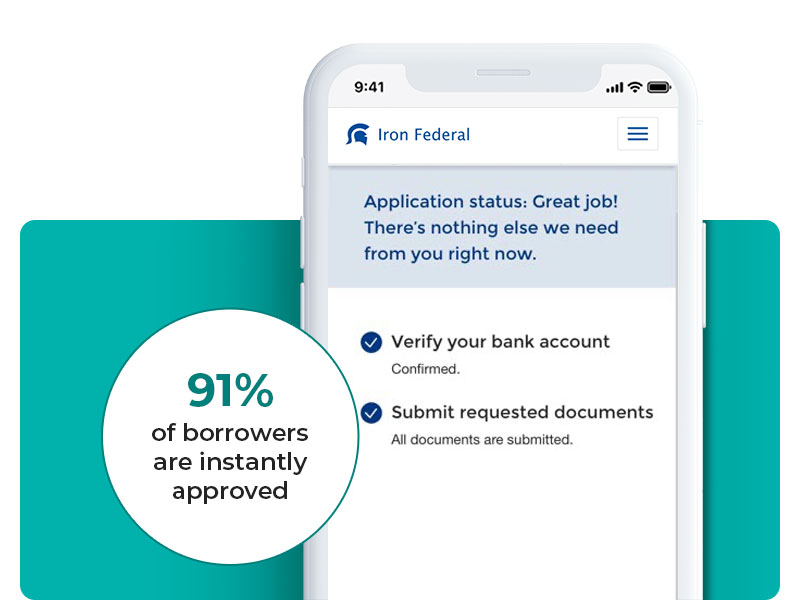

Upstart verifies customer application information providing 91% of borrowers with an instant funding experience.²

Document submission, when required, is seamless and mobile friendly.

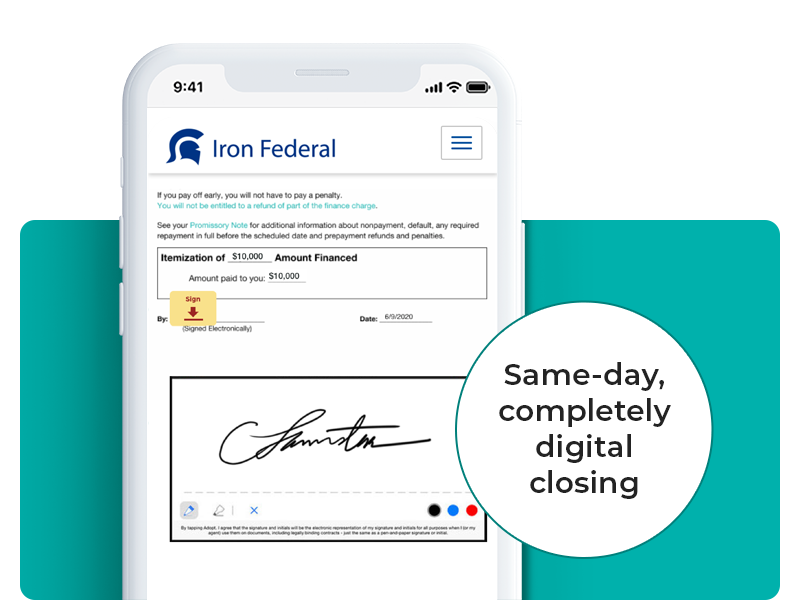

Signature process happens same-day and is completely digital.

Borrower presented with option to directly pay off credit card balances.

Configure rates to meet your desired return on assets tailored to your risk appetite.

Approve borrowers that meet your risk profile – our model predicts the probability and timing of default.

Upstart can present your offer of credit to applicants on the Upstart.com site via the Upstart Referral Network to help you drive origination volume that compliments your existing marketing efforts.

Upstart provides a comprehensive servicing solution that is lender-branded including U.S. based customer support, a payment platform, and collections services.

1 As of publication in April 2025, and based on a comparison between the Upstart model and a hypothetical traditional model using Upstart data from Jan – Dec 2024. For more information on the methodology behind this study, please see Upstart’s Annual Access to Credit results here.

2 In Q3 2025. Percentage of Loans Fully Automated, which is defined as the total number of loans in a given period originated end-to-end (from initial rate request to final funding for personal loans and small dollar loans, and from initial rate request to signing of the loan agreement for auto loans) with no human involvement required by the Company divided by the Transaction Volume, Number of Loans in the same period.